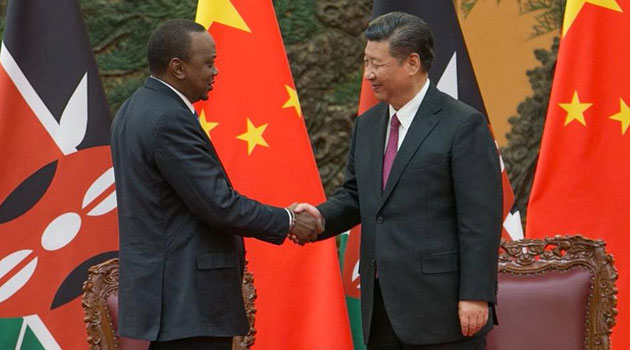

After the latest round of loan talks held in Beijing, Kenya’s debt stock to China crossed the Sh1 trillion mark. This could easily grow by another Sh200 billion should Chinese leader Xi Jinping sign off on President Uhuru Kenyatta’s request to finance the Naivasha-Malaba railway line.

But not everything is rosy in this credit-fuelled affair. Kenya is the third biggest borrower from China in Africa and the strain of the mounting debt is showing. In fact, public outcry is still reverberating following the Jubilee government’s widely unpopular decision to impose a 16 per cent levy on petroleum products to fund the ballooning budget deficit. China has been on a massive lending spree, gifting it an iron grip on Kenya and other African countries that collectively owe the Asian giant more than Sh20 trillion. Benefits accrued from the extensive loans are massive, including a guaranteed market of a billion people and huge interest on the debt – which is often extended in kind rather than in cash.

[Video] One on one with Hon. Wamatangi and Hon. Rose Buyu: Kenya’s debt to China #DayBreak: Hon. Wamatangi: The primary responsibility of every government is outmost financial prudence and the articulation ho.. https://t.co/ckvErbC44p

— Breaking News (@News_Kenya) September 13, 2018

And the debt burden lies crushingly heavy on Africa. Kenya, for instance, will pay Sh122 billion – the equivalent of one-and-a-half-year’s national healthcare spending, in interest between now and 2021. Over that period, the actual loan repayment is only marginally different at Sh139 billion, confirming that China is assured of reaping big over the long term. Faced with the reality that debt repayment is becoming unsustainable, Kenya has considered going slow on direct borrowing and opted for private-public partnerships (PPP). National Treasury Principal Secretary Kamau Thugge said that the Government would create an enabling environment for private investors to put up mega projects on a build-operate-transfer structure. Here, the investor will own the assets, including roads, for some years during which time they will charge users to recoup their investment.

[Video] How Chinese loans are making Africa poorer | Morning Express Press Review: Last week marked a major milestone, or millstone – depending on where one’s seat at the table is positioned – in the countr.. https://t.co/foaAEneg5V

— Breaking News (@News_Kenya) September 13, 2018

Already, major concerns are emerging whether Africa can repay its loans and what would follow in the event of defaulting. Djibouti, which is already in debt distress, is considering handing over several assets to China for a part waiver of loans that are equal to the tiny country’s gross domestic product (GDP). Surprisingly, despite the huge profits earned from lending to Africa’s poorer countries, there are hardly any grants and donations from the world’s second largest economy. The United States remains the biggest donor to the continent, according to the China Africa Research Initiative (Cari), which analyses economic relations. Cari reports that Angola has received more than Sh4.2 trillion in loans from China since 2000, with most of the funds invested in roads and railways.

Today, Angola remains the second largest exporter of crude oil to China, behind Russia. China is the largest crude oil importer in the world at 8.4 million barrels a day, which indirectly gives it the power to determine pricing. A depressed market for crude oil has kept prices low and exposed petroleum-reliant countries, including Angola and Venezuela.